Freetrade: Trade Stocks & Shares for Free

Why Invest in the Stock Market?

Whether you're building a business to become financially free and retire at 40 or whether it's to enjoy life to the full and provide the very best for your family, it will help if you're able to get a good rate of interest on the money that isn't being used in your business. Even Einstein himself said, "Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it."

So it's important that the money you earn is saved and invested intelligently to make the most of compound interest. To the uninitiated, compound interest is the mathematical rule that if something grows by a percentage each year, its growth will be exponential and a graph of its value won't just be a straight line going up, but a line that curves upwards!

It used to be that a decent savings account would be great for this purpose. You might be able to get an account with a High Street Bank, Building Society, or an online provider of ISAs paying 5% or more. Sadly, since the Global Credit Crisis of 2008, interest rates have been very low and it's now hard to find an account that pays even 2%. Given the current rate of inflation (a general increase in prices and fall in the purchasing value of money), if your savings are invested at only 1.5%, they're actually losing value in real terms - you can afford less with them - so it makes sense to look around for other places to invest that hard-earned cash.

Enter the stock market!

A very simple explanation: when you buy shares you buy and own a percentage of a company. For example I currently own 0.00003% (yes it's a very small slice of a very big pie!) of the computer graphics card maker, Nvidia, among others. The value of any company such as nVidia goes up and down in relation to various things including its latest profit figures, industry news, product launches, general market conditions and investor sentiment.

In general, most good companies will grow in value by way more than 2% each year, although of course some won't and some will even drop, giving you a negative percentage if you're unfortunate enough to invest in those. "Spread your risk" as the old adage goes is of course usually a sound strategy. To give an example of the kind of return you can achieve; when the first iPhone was released, I saw the potential in it and after some careful research decided Apple would be a good investment. I bought on 19/03/2007 and sold (very shortly after Steve Jobs sadly died) on 25/08/2011, giving an average annual growth of 84% over those 4 years. Several of my other investments in tech companies have performed even better, so this is the type of return that can be achieved. In general it's probably realistic to suggest that a sensible investor could expect to achieve 10%+ from a portfolio of investments per year on average.

The "FTSE 100" is the average of the biggest 100 companies on the London Stock Exchange and tends to grow on average at over 10% per year although you can clearly see two humps which were the late 90s Dot Com Boom and 2001 Dot Com Bust and the Mid 2000s Bubble and 2008 Credit Crunch.

Why the Commission Matters?

If you're keen to start investing in the stock market - and it's a great thing to do - you'll want to decide how much you have to invest. Don't start out with too much "only invest what you can afford to lose" is one common piece of advice given to new investors.

The way to invest is with a "stockbroker" or just "broker", some of whom you'll recognise, such as:

Just set up an account, transfer some money over, select a company and click buy! Great!

But there's a problem. Let's say you want to start off really small with £100 each across a few companies. When you buy or sell shares with any of the companies above, they'll charge you a dealing fee of around £12 each time. Some charge more, some charge a bit less. Halifax even offer "Low Commission" days where it costs just £4 but unfortunately that's just for UK markets and most of the exciting tech companies are US based (listed on the NASDAQ or the "NAS" as the really cool investors say).

Sure it's only £12 but that's 12% of your £100, and if you remember our 10%+ target from earlier you'll see a problem. If you wanted to spread £500 across 5 companies, that would be £12 each plus another £12 each when you came to sell. Ouch! Your £500 is now £380 before you even start investing! Your ability to achieve 10%+ growth will be seriously affected by having to shell out 12%+ when you buy and 12%+ when you sell. In other words you have to make an incredible 24%+ just to break even!

As the amount you invest increases, the significance of that £12 decreases so up until now, investing has only made sense for higher amounts and this dealing fee has represented a barrier to entry for new investors.

What is Freetrade?

We live in 2017. We regularly talk to computers like Google's Assistant and the Amazon's Alexa. Self-driving cars that can drive from point A to point B on busy roads with other traffic already exist and are just awaiting regulatory approval. Perhaps less impressively, you can place an order on Amazon and that order is fulfilled with very little human intervention other than the delivery driver. Why then, when the process is fully automated, do we still have to pay £12 each time we want to purchase an intangible item such as some shares which are essentially just changes to a database somewhere?

Well, I'm not going to speculate why, and I'm certainly not going to say the word "cartel", but I am going to say that this industry is ripe for a tech start-up to disrupt it and to greatly reduce or even eliminate those (in my view) unfair charges and fees.

Amazingly, one of my former colleagues, a ridiculously smart developer I worked with very closely on many projects over a good few years is one of the founders of just such a tech startup with the other founders being experienced financial professionals from the industry with very impressive backgrounds.

Freetrade have just become a directly authorised stockbroker and will very soon be launching their own platform, initially to a small group of beta-testers (myself included) but then eventually to the public. They will offer commission free sharedealing with their fully automated platform and will make money by offering optional bolt-on services.

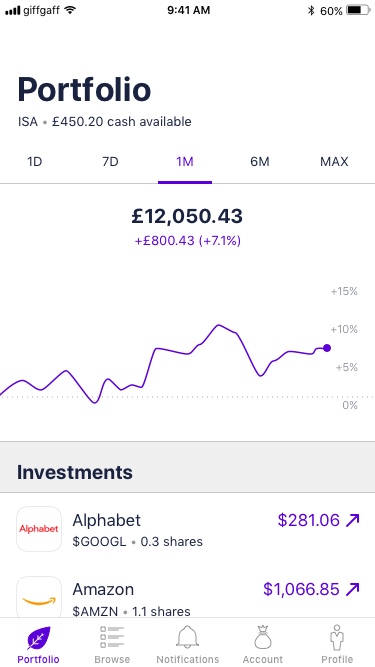

I'm not aware of a release date myself, but I know final testing is already taking place and I have seen the screenshot below so it's clear that the platform is basically complete and now with FCA authorisation, they must be furiously working through a final snagging list before they tentatively open their servers and allow users to start buying shares!

Here's what I've seen so far:

Where do I Sign?

If you're keen to start investing, as well as reading and learning as much as you possibly can about the stock markets and strategies for investing from reputable sources, I would strongly recommend signing up to the email list by clicking the logo below to receive updates on when it will be possible to get an account on the Freetrade platform:

What did you think of this article? Do you invest already and pay £12 a time? Are you thinking of starting to invest? Let us know in the comments!

Disclaimer

I do not provide personal investment advice and I am not a qualified licensed investment advisor.