10 Years Since the Financial Crash

There seem to be a lot of articles in the news this week about the Financial Crash that began in 2008, often also called Credit Crunch or Credit Crisis amongst other things. Speaking to some of my younger staff in the office who were still in education at the time, it was strange to think that they couldn't possibly understand the full magnitude of what happened - a couple of them barely remembered it!

But to those of us who were in industry at the time, it was unprecedented and very very bad.

Roughly what happened in very simple terms?

There was a bubble made of bad debt mortgages and it popped spectacularly.

Ok tell me more, what caused it, how bad was it? How long did it take?

The world had just recovered from the dot-com bubble where investors had got too excited about the Internet and then been let down by crazy expectations that didn't deliver. Things were starting to recover. Money lending, especially mortgages, had become more and more generous and easy to get. Banks were willing to lend to people with a questionable ability to pay back - but it didn't matter because if worst came to worst the bank could just repossess the house, sell it and recover their money right? Wrong.

Now if you're not much of a finance-head, it might not be clear what happened next but it turns out that you can actually sell debt. That's right, if a company owes you £10k, you can sell that debt to another company for say £9k. If they can collect the £10k they have made £1k profit and you have £9k in actual cash rather than £10k on paper. You can sell it even if the chances of being paid are low, and the amount you can sell it for will reflect that.

Mortgages given to people who probably couldn't pay back were called "sub-prime" mortgages. This allowed people all over the US to buy homes they could not really afford. Supply and demand worked the way it always does and the demand for homes pushed prices up further.

The banks who issued these mortgages started to realise they were risky and started selling them in to financial markets. Investment Bankers snapped up these new financial products - essentially bad debts - but the fact they were bad debts was obfuscated by their complexity.

Eventually the time came where these houses needed to be repossessed and the mortgages needed to be repaid. Houses were repossessed in massive numbers and supply and demand again did its thing. House prices started to crash. Now the banks clambered to get rid of the mortgage debt and get their money back as fast as possible, flooding the housing market with distressed sales and driving house prices still lower.

The negative spiral accelerated and on September the 15th 2008, one of the big Investment Banks, Lehman Brothers announced its collapse with 25,000 bankers on the street that morning. The news spread the panic further and from here almost every day there was another announcement of a massive company going under or being in serious financial trouble.

How did it affect people?

This article can't really do justice to the resulting shockwaves that shook the entire world for the next 10 years. Mortgage lending almost stopped, businesses stopped hiring or spending, there was no money anywhere for anything. Everyone wonders where the money went - it was never there in the first place. Governments cut back spending with so much austerity that all public services were drastically affected. It was like the entire world had been plunged in to poverty. The affect this had on health services must have been responsible for hundreds of thousands if not millions of avoidable deaths over those 10 years.

A very good article about what happened is from the BBC here: The Lost Decade

What was my experience of it?

I had been an IT Contractor and head of the web team for almost a year at The Berkeley Group Holdings Plc. with up to 10 other contractors when the news struck. I remember us all reading the news and seeing those surreal images of 25,000 Investment Bankers out on the street in the City with their cardboard boxes of belongings.

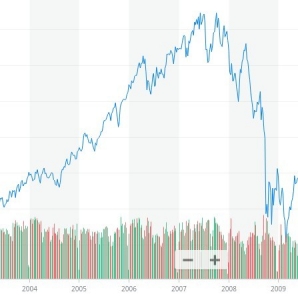

Having been a keen investor since 2005 I was well aware of the markets and could see the impact as it all unfolded.

Over the next few months things started to change. Everything became about cost cutting and even the trusty water cooler was removed - a real sign of the times! One by one, contractors were let go and eventually it got down to just myself as the only remaining contractor. I was given the choice of going permanent or ending my contract and I chose the latter in early 2009.

The IT contract market was now very quiet indeed but I did manage to find short term contracts in London that were good fun over the summer of 2009, although everything was always about cost and everyone was trying to spend as close to nothing as possible.

Not too long after this, in the Autumn of 2009, I went back to the Berkeley Group as a contractor which was very nice but things were different - budgets for everything were lower, every penny was being watched. Of course this was a sensible strategy for any business but the effects of this happening in every business in the land made life harder in every way for pretty much everyone.

In the Summer of 2010 I decided it was time to start Antropy - I'd always wanted to run my own web agency - so I gave my notice and began. I knew there was a recession on, and I knew it would be hard, but this did mean that my first attempts at sales and marketing were always met by "sorry we have no budget". Somehow though, I managed to get enough clients on board to get going, to whom I'm truly thankful, and sales steadily grew and improved from then on!

Final Thoughts

The Credit Cruch and subsequent Double-Dip recession were really very nasty indeed. They affected almost everyone, lowering incomes, standards of living and public services from Policing to Healthcare. They forced people to put their lives and dreams on hold and work as hard as they could just to survive and of course whole generation of young people found themselves finishing education in a shocking job market that didn't want them. Many highly qualified people ended up working in bars and other similar unskilled jobs. It was a difficult time to start a business indeed.

Even a few years after the worst of the recession, it became a sort of taboo to suggest that there were signs of recovery. One politician who suggested so was heavily criticised. Others such as Sir Alan Sugar just didn't want to talk about a recession.

While I'd say the business climate has been fairly ok for the last 5 years or so, we certainly haven't yet returned to the good times of pre-2008. What happens next, only time will tell.

What did you think of this article? Where you were working in late 2008 when it all went so wrong? How did it affect you? Let us know in the comments!

blog comments powered by Disqus